-

Cryptocurrencies

-

Exchanges

-

Media

All languages

At 0:40 am on November 16, 2018, Beijing time, BCH carried out a high-profile hard fork, and the first computing power war in the history of digital currency started. The two sides in this battle of computing power are Craig Wright, who claims to be "Satoshi Nakamoto", and the nChain development team supported by Calvin Ayre, the gambling tycoon behind him, and the Bitcoin ABC development team, and the supporter Bit Mainland founder Wu Jihan and "Bitcoin Jesus" Roger Ver. Since the two parties failed to reach an agreement on how to best develop BCH and deploy updated codes, they eventually moved towards a hard fork. BCH split into two camps, BCH ABC and BCH SV, and agreed to use computing power to determine life and death. BCH was derived from the hard fork of Bitcoin in August 2017. After a lapse of one year, it ushered in a split again, and this time they fought each other through computing power competition without replay protection. As the fourth largest digital currency by market capitalization, the BCH computing power war has attracted widespread attention from the industry and has affected Bitcoin and the entire digital currency market, bringing a profound impact on the future community governance model.

The BCH computing power battle started on the 16th, and lasted for more than a week until November 23rd when the SV side gave up the fight for the naming rights. Since then, the computing power war has officially ended, BCH forked into the original BCH chain and the BSV chain, and BSV was born.

BSV (Bitcoin Satoshi Vision) in which "SV" is the abbreviation of Satoshi Vision (Nakamoto Vision), aims to realize the original vision of large-scale chain expansion and become a global point-to-point electronic cash and value data transmission network.

BCHSV, which will be the replacement chain in the hard fork. His direction is backed by Craig Wright The BCHSV chain will use and follow the original specifications outlined by Satoshi Nakamoto in the Bitcoin white paper, hence the name SV or "Satoshi Vision". For the contentious hard fork, which is proof, the only practical difference between BCHSV and BCHABC is that for the network, SV will have a larger block size of 128MB.

Bitcoin SV offers a new full-node implementation of Bitcoin Cash (BCH), designed to fulfill the vision originally set out by Satoshi Nakamoto in his Bitcoin white paper.

Unlike other competing Bitcoin Cash (BCH) implementations competing to make unnecessary changes to Bitcoin, Bitcoin SV's development planning roadmap is to restore Satoshi Nakamoto's original protocol, maintain protocol stability, implement large-scale Scaling, in turn, allows large enterprises to confidently develop and create project activities on the solid Bitcoin Cash (BCH) foundation.

BSV and "Aoben Satoshi"

At the time when a series of halving frenzy of mining coins is approaching, it seems that the "big bull market" in 2020, which has entered a period of sharply increasing global uncertainties and turmoil, is about to start. From the outside to the inside, the entire currency circle seems to be turbulent under the influence of the global economy. From the inside, it is the bitcoin market that is affecting the overall market trend.

But today we will not discuss how Bitcoin has created the myth of wealth for more than ten years, nor will we discuss whether its final value can reach 100,000 US dollars. Let's look at the complex game of interest in the currency circle from another perspective - the rise of BSV (Bitcoin Fundamental Coin).

Introduction: The Birth of BSV

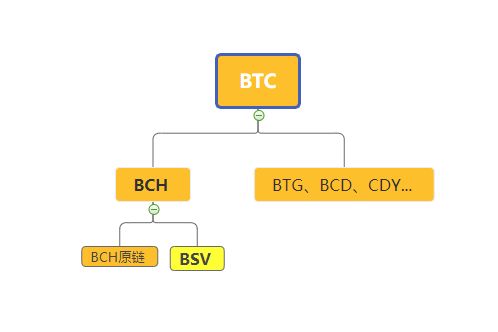

BSV is a fork of BCH, and the relationship between them is as follows:

People who don't know much about BTC may wonder why there are so many forks? Why is BSV, which was born after two forks, so optimistic? Then we need to start from the technical principles of Bitcoin, and the author tries to make it easy to understand.

The technical design defect of BTC has been criticized for its small block size. In the current Bitcoin system, the size of each block is 1M, and such a block is generated every 10 minutes. The size of each most basic Bitcoin transaction is about 250 bytes, and 6.6 transactions are processed per second. Being overwhelmed by VISA and Alipay, which process tens of thousands of transactions per second, such performance is completely insufficient to support commercial applications. Transactions are blocked too much, and it is completely impossible to achieve the original intention of Satoshi Nakamoto to create Bitcoin - to become a global currency. The peer-to-peer electronic cash and value data transmission network.

Regarding the issue of expansion, many geeks and Bitcoin believers have made improvements on the original basis of Bitcoin (thousands of words of factional disputes are omitted in the middle), so a series of forked coins such as BCH and BTG were born At most, there are more than 80 forked coins, but most of them are just to catch the popularity of BTC. At present, BCH and BTG are surviving and recognized by some people.

But the story is far from over. BCH was derived from the hard fork of Bitcoin in August 2017. After a lapse of one year, it ushered in a split again. The reason is that the two development teams of BCH failed to reach an agreement on how to best develop BCH and deploy updated code. , decided to carry out a calculation war.

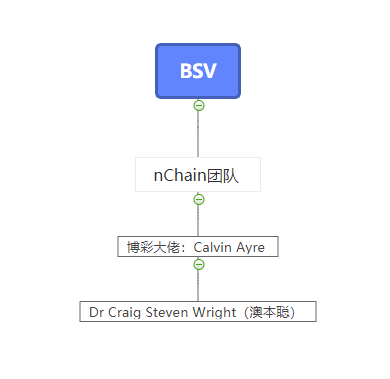

The two sides in the decisive battle are Craig Wright, who claims to be "Satoshi Nakamoto", and the nChain development team supported by Calvin Ayre, the gambling industry tycoon behind him, and the Bitcoin ABC development team, as well as the supporter behind him, Wu, the founder of Bitmain. Jihan and "Bitcoin Jesus" Roger Ver.

As the fourth largest digital currency by market value, the BCH computing power war has aroused widespread concern in the industry and has affected Bitcoin and the entire digital currency market.

BCH算力战从16日开始,到11月23日SV方认输放弃争夺冠名权,持续一周有余。 Since then, the computing power war has officially ended, BCH forked into the original BCH chain and the BSV chain, and BSV was born.

The "SV" in Bitcoin SV is an abbreviation for Satoshi Vision (Nakamoto Vision). This has written a good story for those who believe in BSV. BSV is called the fundamental currency of Bitcoin, which is equivalent to telling everyone that the original BTC can no longer realize Satoshi Nakamoto's vision. It doesn't matter, let's fork another BSV to Continue to complete, whether Satoshi Nakamoto's vision or global commercialization, in short, it has an infinitely bright future. Except for the "Aoben Satoshi" we will talk about later, this concept is one of the reasons why everyone thinks the value of BSV is immeasurable.

The man behind BSV, is he really Satoshi Nakamoto?

After sorting out the origin of BSV, let's continue to understand the nChain team that founded BSV after the failure of the computing power war.

Calvin Ayre, an Australian gambling tycoon, is the actual controller of Coingeek, a blockchain company that provides support for BSV in the computing power war. He first made his fortune through gambling and is a billionaire. CWS, known by the media as "Ao Ben Satoshi", is an Australian computer scientist.

The communication between the two began in 2007, when CWS served as a security consultant for Centrebet, one of Australia's largest online casinos, and met the network leader S of the project. In 2010, S again Became the CTO of one of the gaming giants CA (abbreviation), and then CSW also joined through his introduction.

CA once said in an interview with Planet Daily: "...CSW (Craig S. Wright) who created Bitcoin was working under me at the time, but I didn't know him. Many people know Bitcoin Coin is also because of Craig.

Then around June or July 2015, I met Craig and he explained the principles to me and made me connect the dots and I finally understood the technology What it means. I’ve been more actively involved with the technology since then.”

In other words, CSW was introduced by colleagues to join CA's company, and then "Amway" BTC to CA. Then there was a series of "Aoben Satoshi", BSV project, Tulip Trust...

At present, there are 2 circulating versions about the cooperation between these two people.

One theory is that CSW, as the real Satoshi Nakamoto, recommended BTC to CA and convinced him that he is really Satoshi Nakamoto. The reason for creating BSV is to realize the vision. CA even said in the interview, BCH is nothing in the end. Everyone attacks BSV just because they are afraid that CSW's technology will surpass the original BCH.

Another way of saying is that CA, a business-minded billionaire, found CSW, a technology giant, hoping to join him in "big things", so he packaged CSW as Satoshi Nakamoto and pushed it to the front. It was planned and premeditated. At that time, CSW's own company was facing problems such as the collapse of Mentougou, ATO investigations (fraudulent tax refunds and tax evasion), and was burdened with huge personal debts. At this time, the big boss CA agreed with his subordinates to provide a generous bailout of 15 million US dollars, which was given to CSW in June 2015. To survive the predicament, CSW has to meet two obligations: 1. Transfer all Bitcoin intellectual property rights; 2. Tell the media that I am Satoshi Nakamoto.

So how to package a Satoshi Nakamoto? This is a big job.

Making Satoshi

Even people with Indian nationality and Pakistani nationality have stood up and said that they are Satoshi Nakamoto, and they have been ridiculed and debunked by the media and community members one after another. CA or CWS may know this well, choose a third party to announce the identity of "Satoshi Nakamoto", and win the start.

On December 8, 2015, WIRED magazine and Gizmodo magazine published articles at the same time, claiming to have discovered that the identity of Satoshi Nakamoto may be the Australian computer scientist CSW.

WIRED magazine and Gizmodo magazine claimed to have obtained a series of anonymous news emails. The clue provider not only claimed to know the real identity of Satoshi Nakamoto, but even claimed to have worked for him.

The hacker said "I hacked Satoshi Naklamoto, and these files were obtained from his business account. This person is Dr. Reg Wright". Gizmodo then received a stack of email files, apparently pulled directly from the Outlook account of Australian academic, computer engineering expert, and serial entrepreneur CSW.

The evidence provided by WIRED Magazine and Gizmodo Magazine is as follows (Note: The following evidence cannot be verified or falsified):

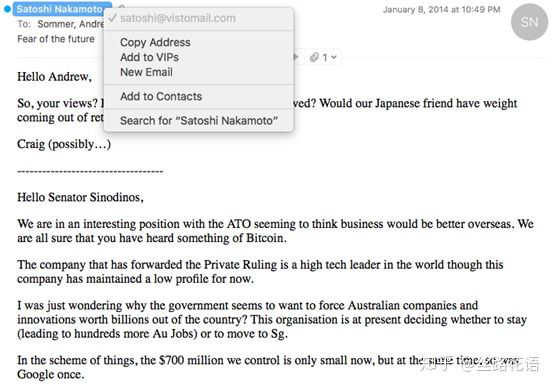

February 2014, Transcript of meetings between CSW and his own lawyers and the Australian Taxation Office on bitcoin regulation issues, CSW seems to have been trying to persuade the Australian government to treat his bitcoins as currency, while It is not an investment product that must be taxed. Without this regulatory move, his business interests would suffer. His angry words are quoted in it: "I tried my best to hide the fact that I have been operating Bitcoin since 2009," CSW said. "By the time this is over, I think half the world will know." Gizmodo magazine interviewed multiple people involved in the minutes of the meeting, and they confirmed that they did attend the meeting.

CSW tried to contact the Australian Senator via email at satoshi@vistomail.com to ask about Bitcoin regulation and try to convince the Australian government to use his Bitcoin as a currency rather than a tax that needs to be levied asset. Nakomoto used this email address to be in regular contact with early Bitcoin users and developers.

Another email showed that CSW entrusted 1.1 million bitcoins to partner Dave Kleiman to set up the Tulip Trust. The email also showed that Dave Kleiman agreed that he would not disclose that "satoshin@gmx.com, which is the email address where Satoshi Nakamoto published the white paper, belongs to CSW. (The above information source @Silk Road Flower Language)

The summary is that in order to convince everyone that CSW is Satoshi Nakamoto, the exposure process was "designed" into two parts:

1. It was announced by two magazines that CWS is Satoshi Nakamoto. The clue provider is the hacker who hacked the CWS account. The main proof documents are the emails CWS sent to the Australian government to "Amway" Bitcoin in 2014, and CWS used the hacked It is recognized as the email address of Satoshi Nakamoto's account;

2. CSW commissioned partners to set up Tulip Trust. This move has three functions. First, he has a part of the private key of the Tulip Trust, (Note: 825,000 bitcoins are locked in the Tulip Trust with its locked key and address, and the trust fund has used its private The key is encrypted into 15 parts, 7 of which are controlled by him.) You don’t need to immediately prove that you really own a large amount of Bitcoin; second, to prove to the public that you are Satoshi Nakamoto, one of the strong proofs you need to show That is, the over 1.1 million BTCs dug up in the genesis block, the Tulip Trust is a good avoidance solution; third, Dave Kleiman, the partner of the trust, is the Bitcoin successor appointed by Satoshi Nakamoto.

Has CSW fulfilled his wish? not.

Although Gavin Andresen, who had participated in the development of Bitcoin and established the Bitcoin Foundation, endorsed CSW, saying that he is the father of Bitcoin, the entire encryption community still does not buy the new Satoshi Nakamoto.

Even the judge who tried the case at the time (Partner Dave Kleiman's brother v. CSW) said: I completely deny Dr. CSW's testimony regarding the so-called tulip trust fund, the so-called encrypted documents, and his alleged inability to identify him Bitcoin holdings. Dr. CSW's only hope is a secured courier arriving to an unknown location in January 2020 with a decryption key. If the courier that David Kleiman commissioned to deliver the trust key slices doesn't show up in 2020, Dr. CSW loses his ability to access billions of dollars worth of Bitcoin, and he doesn't seem to care, inconceivably. These go against common sense and real life experience.

In addition to those unverifiable and unfalsifiable emails, CSW also tried to prove itself as the creator of Bitcoin by publicly displaying the digital signature of its early Bitcoin development key matching the block mined by Satoshi Nakamoto , though this evidence was later shown to have been copy-pasted from Satoshi Nakamoto's publicly available old signature.

For the encryption community, there is only one way to prove that they are Satoshi Nakamoto, and that is to show the signature of the founding block, or to move the digital currency that Satoshi Nakamoto should have. CSW promises to move the bitcoins of the first block and at the same time proves its identity by signing with the private key of the block.

Not long after that, CSW repented and sent an open letter to explain the reason for repentance. The general content is: I don’t think I have the courage to prove that I am Satoshi Nakamoto now...

The people who eat melons are confused, and they are even more suspicious of CSW's series of rhetoric.

What happened in 2016 should have been silent by now. But in 2018, CSW's former partner Dave Kleiman had died for 6 years, but his younger brother Ira Kleiman took CSW to court, claiming that CSW embezzled Dave's 1.1 million bitcoins, worth 10 billion, and related bitcoin intellectual property rights. This kicked off the famous million-dollar bitcoin (now worth $9.6 billion) lawsuit in the currency circle.

It all starts with the Tulip Trust, which is also a core part of the BSV myth.

Tulip trust and BSV madness

The latest development of the Tulip Trust case was originally scheduled to be announced and unlocked in January 2020, but it was postponed again.

According to the court documents of the South Florida District Court, U.S. District Judge Beth Bloom stated that CSW was accused of interfering with the Dave Kleiman estate case. Some facts that previously affected the outcome of the trial are in dispute, so the extension of CSW's unlocking and delivery of the corresponding in the Tulip Trust Amount of BTC is due until February 3rd.

Why did the unlocking of the trust have many twists and turns, and it has attracted the attention of all people in the industry?

There are two key reasons: 1. If the trust is really unlocked, it will largely prove that CSW or its partner Dave Kleiman, one of them is Satoshi Nakamoto, and Dave Kleiman had a motorcycle accident in 2013 Died unexpectedly in a car accident.

2. It is rumored that CSW will use half of the 9.6 billion US dollars unlocked by the trust (the other half may be awarded to the partner's brother by the judge) to support BSV, so that BSV will get the biggest explosion in history, possibly Straight ahead of BCH.

In short, as long as it is unlocked by trust, 50% of the 9.6 billion funds will be obtained by CSW. Regardless of whether this huge amount of funds is used to support BSV, BSV will rise sharply.

But the announcement of this answer has been postponed to February 3rd. Will BSV skyrocket by 3-4 times during this period? I am afraid that everyone is ambiguous in their hearts.

The original text of Tulip Trust is Tulip Trust, and it is not a different name in Chinese translation. The Tulip Trust first came into public view in December 2015, according to leaked documents leaked to the press by hackers. The document, purportedly written in 2011 by forensic computer investigator and author Dave Kleiman, describes a trust fund containing 1,100,111 bitcoins that CSW merged with in 2009. Bitcoins mined and purchased through 2011 "will be managed by at least three but no more than seven persons at any one time." In order to prevent the funds from being misused for various reasons during the custody period, the private key Divided into seven, the document states that all private keys in trust will be returned to CSW on January 1, 2020.

According to the price of Bitcoin in 2014, the total value of more than 1 million BTCs kept by the Tulip Trust is only hundreds of millions of dollars, but CSW or Dave Kleiman seems to have expected it, and named the trust "Tulip". In just a few years, more than 1 million bitcoins have been worth more than 9.6 billion U.S. dollars. This bubble is called a tulip.

But it is precisely because of such prophets that people have to suspect that the trust exposed to the media by hackers in 2015 seems to have been designed early on. But in the tulip trust lawsuit, the version of the story that convinced the judge but sounded very contrary to reality was: the plaintiff claimed that his brother Dave Kleiman was a partner in the creation of Bitcoin, and Dr. CSW embezzled his brother's 550,000 bitcoins and Bitcoin and intellectual property. His brother was hospitalized in 2010, and his health was deteriorating. Before he died in 2013, he did not leave a will to tell his family that he owned 550,000 bitcoins and intellectual property rights, and did not leave any information related to bitcoin. After his death, he was impoverished and owed a lot of debts to the bank, and the house he lived in was confiscated by the bank.

The younger brother also believed that his brother had nothing but debts, until his brother’s partner, Dr. CSW, wrote an email to the plaintiff in 2014, telling the plaintiff that his brother participated in the creation of Bitcoin, and asked him to keep his brother’s hard drive. There may be hundreds of thousands of bitcoins, but the plaintiff said that I have formatted my brother's hard drive, what should I do?

Dr. CSW also told the plaintiff that he would be given $12 million and a 50% stake in the company. Later, the plaintiff did not realize the fact that his brother's partner had embezzled 550,000 bitcoins and intellectual property for four years from 2014. Finally, when Bitcoin rose to $20,000 in 2018, he suddenly woke up from his dream and filed a $10 billion lawsuit in the Florida court of the United States.

Moreover, the evidence of the trust documents provided by the plaintiff in the lawsuit is consistent with the previously exposed documents. Assuming that the trust really exists, why doesn't the plaintiff have any evidence of the trust left by his brother? The attribution of 1.1 million bitcoins worth 10 billion US dollars in the Tulip Trust is the reason for the lawsuit and the focus of the lawsuit. Moreover, all the evidence and the people involved cannot be falsified or verified. It is a deadlock. , even if he knows that his brother has not participated in any trust management, he will not tell the truth.

I personally feel that Dr. CSW took the initiative to contact the plaintiff, and this act of shooting himself in the foot is not in line with the genius setting of "the father of Bitcoin"?

But his background is far from simple. This is also the reason why other Satoshi Nakamotos were quickly cracked down by everyone and disappeared, but CSW was able to delay the lawsuit again and again, like Sun Yuchen, repeatedly letting everyone dove, and still gaining a large number of believers.

According to public information, CAW has multiple bachelor's and master's degrees and doctoral degrees in economics, computing, statistics, mathematics and law. He also holds more than one computer technology certificate, and in addition to his numerous degrees, he also holds 24 GIAC security qualifications. These are the highest security honors in the field of computer science. (CSW's GIAC certification can be seen here: https: //www.GIAC.org/certified-professional/craig-Wright/107335< /span>). CSW is also the world's first IT Global Information Assurance Certification (GIAC) Security Specialist (GSE).

As of July 2015, CSW was the CEO of about 15 companies.

He does own a large amount of Bitcoin assets. WIRED Disclosure Dec. 8, 2015: Another clue to CSW's bitcoin wealth was not leaked to WIRED but remained on the corporate advisory firm's website, a report on several companies CSW founded One of Hotwire's liquidation reports.

Hotwire tried to create a bitcoin-based bank, and data shows that CSW's bitcoin holdings returned $23 million to the startup in June 2013. The money was worth more than $60 million at the end of 2015. At the time of founding the company, CSW's investment in the company alone accounted for more than 1.5% of the total bitcoin in existence, an oddly large sum for an unknown player in the bitcoin world. In addition, it was disclosed from the 2014 tax minutes that CSW purchased the bank's core code with 450,000 bitcoins worth 50 million.

According to the above information, it can be known that CSW has multiple degrees, and even a security expert from GIAC. The role of "Satoshi Nakamoto" to collect money, not to mention that after the exposure, he was not only investigated by the Australian Taxation Office, but also the company was liquidated, his reputation was discredited, and he was regarded as a liar by the encryption community he admired... Insufficient motivation and Without gaining any substantial benefits through the exposure, CSW's statement of pretending to be Satoshi Nakamoto seems too unreasonable, so far the whole incident has fallen into a puzzle.

Unless CSW gets the private key to unlock the trust and obtain the ownership of BTC worth 9.6 billion US dollars, BSV will always have a story to tell, and the truth is not so important.

As early as 2013, there was a saying about BTC: Bitcoin is definitely a scam, but it is strange that it is designed to deceive the smartest people in the world, and fools can't get in yet.

Now it seems appropriate to put it on BSV, Satoshi Auben, and Tulip Trust. It is definitely a scam, but only smart people are fooled.

Will BSV skyrocket to $1,000?

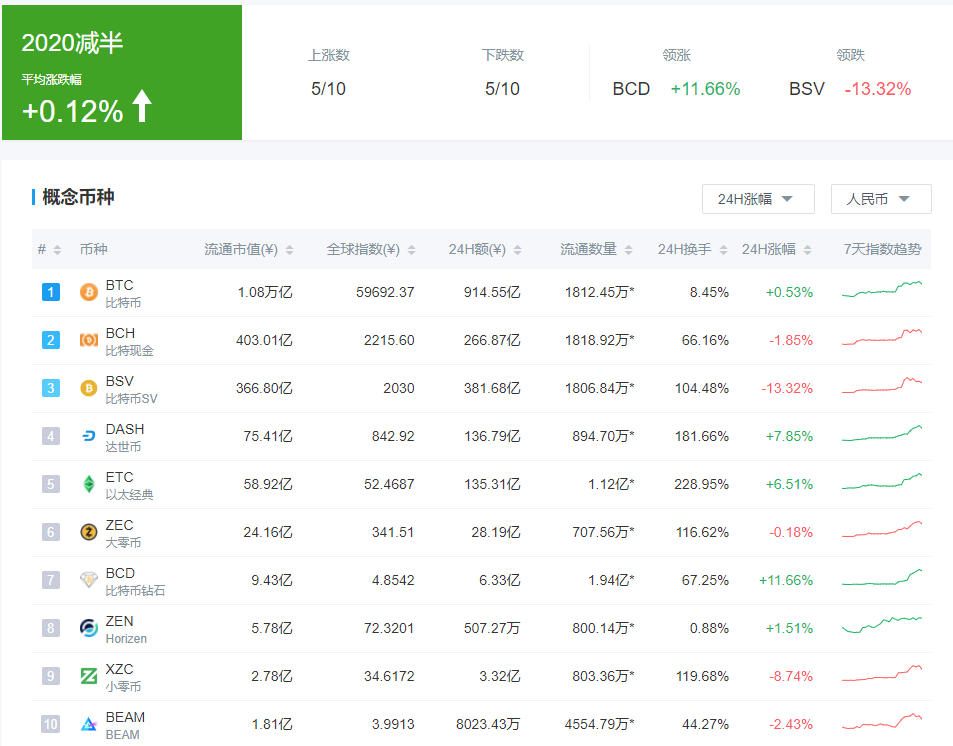

According to market data, BSV has recently surged nearly three times, from $97 to a maximum of $459, an increase of 373%.

Different from small currencies that can easily double dozens of times, the mainstream currency has risen to the fourth place in the market value in a short period of time, which is already an increase that cannot be underestimated. Although the $400 at the highest point in this wave of promotion is still more than half the distance from the $1,000 shouted out by community supporters, BSV has indeed made investors/speculators in the entire currency circle see its brutality and madness. There will be another pull up, and more funds may rush in due to FOMO sentiment.

In addition to the transfer of funds by retail investors, we can look at the computing power again. BTC, BCH, and BSV are all based on the SHA256 algorithm. The same mining machine can mine these three cryptocurrencies. According to the principle of maximizing profits, which currency is the most profitable to mine, the computing power will flow into that currency. BSV's computing power has doubled through this surge. Let's not forget what we said earlier. The birth of BSV is because of the computing power war. The goal of the gambling boss is to make BCH become useless Value, if the computing power of BTC and BCH starts to pour into BSV, it will only be a matter of time before the computing power of BSV surpasses that of BCH.

So one day, will BSV become a real BTC? In terms of technology, in fact, many cryptocurrency enthusiasts are not only not optimistic about the story of Satoshi Auben, but also BCH and BSV.

Satoshi Nakamoto's vision is to make BTC a universal peer-to-peer electronic cash and value data transmission network. Now the only shortcoming seems to be performance issues. Then expand the block and increase the number of transactions, so that "perfect" can be achieved. BTC"?

The problem is far from simple. Some netizens believe that increasing the size of the block will bring about another serious problem-increasing transaction costs, and the Bitcoin system has almost the same transaction costs regardless of whether it is a large transaction or a small transaction. When the block increases the transaction cost, the transaction revenue will be less than the transaction cost for small transactions, and small transactions account for the vast majority of transaction volume, which will make most transactions unsustainable, and the entire system breakdown. In the future, BTC can become a blockchain ledger that is only used for large-value transactions, and it can also continue to operate in a healthy manner. However, BCH and BSV are also engaged in large-block transactions. Their own users and transaction volume have not reached this level. The future situation is indeed Not optimistic. This is also the core reason why many people are technically not optimistic about either BCH or BSV.

To sum up, from the perspective of short-term news and marketing stories, it does not matter whether the evidence behind BSV is true or not, whether it will rise and whether it can attract more and more speculators is the key The key to the direction of BSV; From the perspective of long-term technical logic, BSV has not yet achieved the true "Satoshi Nakamoto Vision", and the BTC fundamental currency is just a gimmick that supporters are willing to believe.

BTC, BCH, and BSV will all be halved in the first half of this year. The troika of the Bit family may lead all halved currencies to new heights. What should we do? I don’t know if you have seen it. There is a saying that you will never make money beyond what you know, or that the money you make by luck will eventually be lost by strength. What I want to remind everyone here is to read and understand all the project information about BCH and BSV as much as possible before the halving, and fully expand your information capture network. First, distinguish every time the market releases news about these projects, which ones are sensitive information that affects the trend, and which ones are irrelevant and rhythmic, and then you can earn the money you should have earned through cognition.

When you can't predict the market, prepare bullets and maps, know how to take the route, and when to snipe.

Related information:

Existence is truth, rising is truth-----BSV

https://mp.weixin.qq.com/s/hNWFGKf2qGAfELiln_KuyA< /span>

《A Comparative Analysis of Bitcoin Forks》

https://mp.weixin.qq.com/s/yLzhHiaOWWNqBN0JVl2VKQ