-

Cryptocurrencies

-

Exchanges

-

Media

All languages

MakerDAO is a decentralized autonomous organization and smart contract system on Ethereum, providing the first decentralized stable currency Dai on Ethereum. DAI is a hard currency backed by digital asset collateral, and it maintains a 1:1 anchor with the US dollar. MKR is the governance token and utility token of the Maker system, used to pay the stability fee for borrowing Dai and to participate in the governance system. Unlike the Dai stable currency, due to its unique supply mechanism and its role on the Maker platform, the value of MKR is closely related to the performance of the entire system. The decentralized stable currency Dai has key applications in mortgage loans, leveraged transactions, hedging, international remittances, supply chains, and government public bookkeeping.

1. Maker DAO Token

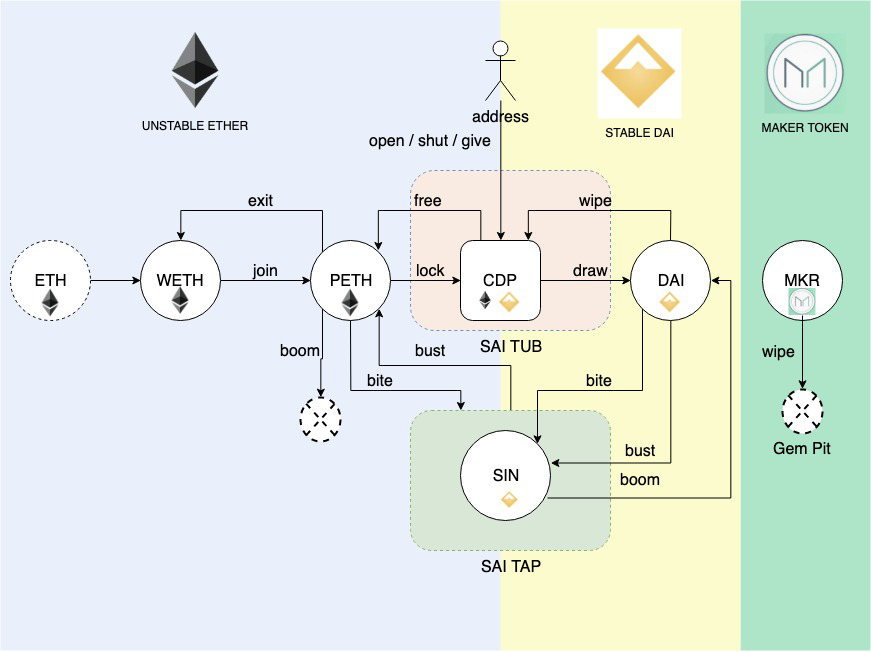

The Maker DAO system is composed of multiple smart contracts (Sai Tap, Sai Tub, Vox, Medianiser, etc.) and ERC-20 tokens. Together, they ensure the stability of the DAI token.

2. Project Features

1. Balance the contradictions in the system:

If ETH depreciates rapidly, the value of Dai's collateral will drop rapidly, causing the system to collapse. A large number of users holding Dai will experience a run on Dai, and the value of Dai will depreciate rapidly. Just as a large number of depositors ask for deposits from banks, the liquidity of banks is tight. So Maker created the MKR token. Let the collateralization rate of CDP be determined by the vote of MKR holders. As the administrator of the system, you will get certain rewards. However, when the collateral in the system is insufficient to cover the value of Dai, MKR will create new Dai to make up the value. This provides a strong incentive for MKR holders to regulate the coefficient of Dai creation. If the system fails, it is they who lose, not Dai holders. Through the MKR token, the contradictions in the system can be balanced, the value of Dai can be stabilized with the US dollar, and the confidence of investors can be enhanced.

2. Ultimate Guarantee-Global Liquidation:

Although the system has layers of protection to avoid crashes, the Maker team has created a global liquidation system to protect the interests of users. to withstand unforeseen crises. When the global clearing system is triggered, the entire system will be frozen, and all Dai and CDP holders will be returned their collateral. If a global settlement procedure is triggered, the user owns 100 Dai, and 1 ether is worth $100, the user can directly exchange their 100 Dai through a smart contract. Global settlement can be triggered by a group of trusted persons who hold global settlement keys. The only thing that global clearing can do is to return your collateral, and it will not trade on your behalf. Therefore, it is a decentralized design that can help you recover the largest loss.

3. Leverage function:

In the Maker system, it can be found that Dai is actually a loan in exchange for ETH. Users can continue to use Dai to buy ETH in the market, and then recycle it. Although the mortgage rate gradually reduces the amount of Dai loaned out, it also allows users to use several times the leverage, and the financial attribute is very strong. This is like continuing to buy real estate with the money loaned out by the mortgage bank. It is all financial leverage.

Related links:

https://linux.cn/article-10862-1.html

https://makerdao.com/zh-CN/