-

Cryptocurrencies

-

Exchanges

-

Media

All languages

dFuture is a decentralized derivatives exchange using the QCAMM protocol and a DeFi derivatives exchange built on the basis of QCAMM. dFuture is positioned as the best, fairest, and lowest-cost decentralized contract exchange, featuring external price feeds, zero slippage, excellent trading depth, and zero impermanent losses. By integrating contract trading and liquidity, dFuture has completely revolutionized the existing trading model, allowing traders, LPs and arbitrageurs to have a fairer, safer and more profitable trading environment. The project was initiated and incubated by Mix Labs (Mix Labs) under the Mix Group. Mix Group has previously successfully incubated several blockchain projects and teams, including Lianwen, MixMarvel, TokenView, Mixpay, etc.

The new upgraded version of dFuture V2 has been officially deployed on Ethereum Layer 2 on November 17, 2021. At the same time, with the help of Arbitrum's Layer 2 technology, dFuture's contract transactions will no longer be limited to the 3 seconds of BSC and Heco The technical limitation of block confirmation will greatly improve the function of dFuture. First, the external quotation will be completely real-time, and traders can trade according to the real-time price; second, the confirmation time of the transaction will be increased from the original 3 seconds to milliseconds Level, traders will not perceive the transaction confirmation time at all, and the transaction process will be as smooth as a decentralized exchange. In the future, dFuture will continue to deepen the industry, polish products, and bring more and better benefits to users.

Token Model

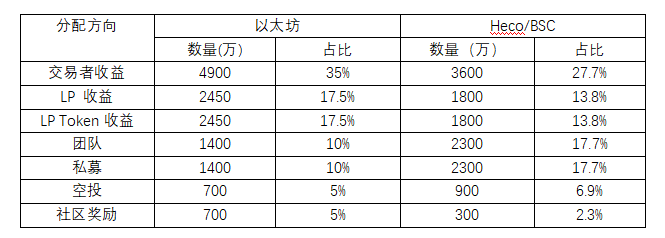

The total supply of dFuture's platform token DFT is about 400 million, of which the total supply of Ethereum chain DFT is 140 million, the total amount of Heco chain DFT is 130 million, and the total supply of BSC chain DFT is 130 million.

DFT分配有以下几个方向:

1)、交易者收益:分配给在平台完成有效交易的交易者,即交易挖矿;

2)、LP收益:分配For LPs who provide liquidity mortgages for the platform, LPs will be obtained according to their mortgage ratio, that is, liquidity mining;

3), LP Token income: provided to users who provide liquidity for DFT on DEX, that is, LP Token mining mine;

4), team: as a team reward, used for team operation, technology research and development, etc., linearly unlocked;

5), private placement: as an early investor share, to provide more sufficient and beneficial for the development of dFuture Funds and resources are unlocked linearly;

6), airdrops: in order to promote the dFuture platform, multiple airdrops are conducted for potential user groups such as traders and Defi community members;

7), community rewards: in order to improve the functions of the platform , to reward active players in community activities, and reserve DFT for rewards in various community activities.

Currently, the dFuture V2 version is deployed on the second-layer Arbitrum network of Ethereum. Due to the different block generation methods of Arbitrum, part of the transaction mining and LP Token mining rewards of Ethereum are no longer accompanied by block generation, but are based on activities Mining is carried out in the same way, and each activity sets the total DFT reward during the activity period.

Token usage scenarios

At present, there are five main functions of DFT: transaction profit distribution, repurchase and destruction, transaction fee discount, LP lockup acceleration and DAO governance voting rights. The specific rules are as follows:

• Transaction profit distribution dFuture

Platform users can mortgage DFT on the platform, according to the proportion of their mortgaged DFT in the total mortgaged DFT, to obtain an equal proportion of 40% of the platform transaction fee, and this part of the fee is paid to the user in the form of USDT.

• Repurchase and Destruction

The dFuture platform will use 20% of the total fee income for repurchase and destruction of DFT.

•Discount on transaction fees

Traders can get discounts on transaction fees after mortgaging DFT.

•LP lock-up acceleration

LP can mortgage DFT to speed up the process of mortgaging USDT to obtain DFT. When LP mortgages USDT to provide liquidity, it can also mortgage DFT to accelerate its mortgaged USDT. At present, when LP mortgage is accelerated, the ratio of DFT to USDT is 1:2, that is, 1DFT can accelerate 2USDT.

•Voting rights for DAO governance

All mortgaged DFTs, including DFTs mortgaged for trading dividends, DFTs mortgaged for LP lock-up acceleration, or DFTs corresponding to the second pool of mortgages, will receive corresponding votes The community can vote to modify and adjust all parameters of the dFuture platform, so as to meet the needs of more and different traders and LPs.