Bitfinex and Tether deny all allegations in an amended class action lawsuit filed against their parent company iFinex Inc.

The total circulation of USDT reached 9.36 billion US dollars, and the total market value ranked third, an increase of 1.34 billion US dollars from April.

The total issuance of USDT reached 8.02 billion US dollars, an increase of 1.77 billion US dollars from March.

Tether issued an additional 2.188008006 billion USDT.

Tether announced the launch of Tether Gold (XAUT), a stablecoin linked to physical gold, which will be issued on ethereum and tron as ERC-20 and TRC-20 tokens.

Tether issued an additional 1,018,652,600,000 USDT.

As plaintiffs, five U.S. citizens holding cryptocurrencies filed a class action lawsuit against related companies and natural persons such as Tether and Bitfinex.

Tether issued an additional 6.0625 billion USDT.

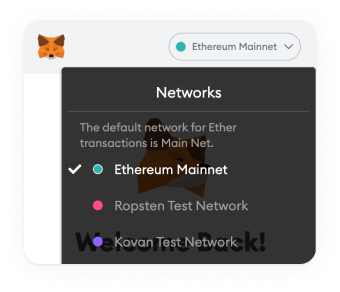

Tether has announced the launch of CNHT, a stablecoin pegged to the offshore Chinese yuan (CNH), issued as an ERC-20 token on the Ethereum blockchain.

Bitfinex plans to raise $1 billion through IEO.

Tether issued an additional 1.063801 billion USDT.

Tether issued an additional 640 million USDT.

The New York State Attorney General’s Office (NYAG) is suing Bitfinex and Tether, saying the companies “are committing fraud.”

Tether revises the terms of service, USDT’s endorsement becomes 75% USD pegged, and 25% iFinex stock guarantees the loan.

The U.S. Department of Justice (DoJ) is investigating whether Bitcoin’s 2017 rally was fueled by Tether manipulation.

Tether published its third audit report (conducted by Deltec Bank), confirming that as of November 1, 2018, Tether had a corresponding $1.8 billion in reserves.

Tether announced a partnership with Deltec in the Bahamas and released a $1.83 billion asset certificate issued by the bank.

Bitfinex and Tether enter into partnership with Deltec Bank in the Bahamas.

Tether has published its audit report for the second time (conducted by law firm Freeh, Sporkin & Sullivan), confirming that as of June 1, 2018, Tether had a corresponding $2.5 billion in reserves.

Bitfinex and Tether have partnered with Noble Bank of Puerto Rico.

An anonymous report pointed out that as of January 4, 2018, Tether had issued a total of 91 additional USDTs.

Tether announced that it will issue EURT that is 1:1 exchangeable with the euro and will be compatible with the ERC20 standard.

Bitfinex and Tether have been subpoenaed by the U.S. Commodity Futures Trading Commission (CFTC) over issues such as lack of transparency.

Tether's first published audit report (conducted by New York accounting firm Friedman LLP) confirmed that as of September 15, 2017, Tether had a corresponding $443 million in reserves to back it up.

The value of Tether in circulation rose from $7 million to $320 million.

Tether broke its 1:1 peg to the U.S. dollar for the first time, trading at a 10% discount while being cut off from banking.

Wells Fargo Cuts Off Bitfinex Banking.

Three bank accounts established by Tether in Taiwan were blocked.

USDT was officially released, and Bitfinex announced support for USDT transactions in the same month.

Realcoin changed its name to Tether and announced a partnership agreement with Hong Kong-based bitcoin exchange Bitfinex.

RealCoin was jointly established by Brock Pierce, Reeve Collins and Craig Sellars and registered in the Isle of Man and Hong Kong.

See More